IMCI+ Corporate Finance

IMCI+ is offering a wide range of corporate finance and advisory services:

Further to that, IMCI+ Advisory and Coaching also can deliver services to the client, in coaching and sparring partnering that will help you in the negotiation process with investors. Side by side, with the client, the advisor, coach or interim managers can help achieve best results during the process.

- elaborating risk mapping and Free Cash Flow driven by previous assessed factors

- assessing Risk-Return Trade off of the project

- assessing Value using DCF and comparable multiples

With the Standard Valuation IMCI+ Group helps:

I. Assess current value by studying financial statements, forecasts and information provided by the client (including latest audited BS and P&L);

II. Make sure that the information sent by the client is accurate in terms of market, sector and stage of development;

III. Identify and assess value-risk drivers affecting the company / project;

IV. Prepare a risk-value map and helps to define the best communication approach with potential investors;

V. Risk-return trade-off assessment: (Is the company underperforming? Why?)

VI. Work on a value creation plan and presentation;

VII. Assess the fair value of the company but at same time make sure the full potential of the company is well demonstrated in the presentation,

VIII. Deliver a complete Valuation Report with remarks and recommendations

With the Strategic Valuation, IMCI+ Group helps:

I. Assess current value by studying financial statements, forecasts and information provided by the client (including latest audited BS and P&L),

II. Make sure that the information sent by the client is accurate in terms of market, sector and stage of development,

III. Identify and assess value-risk drivers affecting the company / project,

IV. Prepare a risk-value map and help define the best communication approach with potential investors,

V. Risk-return trade-off assessment: (Is the company underperforming? Why?),

VI. Elaboration of risk-value mapping with value creation plan,

VII. Final value assessment showing present value, restructuring opportunity value, financial opportunity value, strategic opportunity value and synergic value,

VIII. Recommendations for future strategy,

+ Accounting, tax, labor and financial audit,

+ Environmental audit

+ Operations and Internal Process audit,

+ Legal audit (by a local lawyer),

+ Technology audit (by an Engineer of that sector),

+ Market audit,

+ Marketing audit,

+ Management audit.

+ Information systems audit.

+ Intellectual Property audit

+ Insurance audit

+ Reconciliation audit which links/consolidates the output of the DD with the Valuation Report made during the pre-valuation service. If necessary, the strategy defined during pre-valuation service will be modified and/or updated according to the output of the DD.

Further

IMCI+ is financing projects only ON SUCCESS and VALUE. The success is measured at two phases: 1. Engagement Phase and the 2. Execution phase. The Value is the quality job, the advisory and the business coaching, the modeling of the solution, the intermediation and coordination with the investor and the project management. At IMCI+ you get what you pay for.

In the Engagement Phase: The following tasks and responsibilities are covered by IMCI+ Financial Services at this point, without been paid in ADVANCE, but only the success of obtaining the Letter of Funding Commitment (Terms Sheet)

1. Origination Work (IMCI+ business associate/partner)

2. File Setting

3. Desk Assessment

4. Investor Double-Check

5. Pitch Call with Client

6. Pitch Call with Investor

7. Proforma FS-Agreement with IMCI+

8. Copy of Investors LFC and JVA

9. Negotiating Pre-Acceptance from Investor

10. FSA Final. Service Agreement

11. Application Letter

12. Teaser

13. Presentation Application

14. Negotiating Funding with Investor

15. Submitting Letter of Funding Commitment to client

16. Closing File / Engagement Phase

In the Execution Phase: IMCI+ will coordinate the negotiation of the Joint Venture Agreement and the Loan Agreement, finally also the materialization of the funds and the related drawdown into the project. For the materialization of the funds, IMCI+ will obtain 5% fees of each drawdown realized into the project. This amount is paid directly from the Joint Venture IMCI+ escrow account. The 5% is added to the loan. If the client or the investment party request further business advisory, coaching or interim management, this will be agreed by a separate term sheet and engagement agreement.

Our corporate finance solutions are covering the following value circle:

Engagement towards clients

IMCI+ is committed to the IMCI+ code of conduct developed by a team of partners and associates. Further, we follow the GDPR policies according to the European Privacy regulations. We strive for transparency, integral business, professionalism and partnership.

IMCI+ is not operating in any MTM or issuing SBLC/BG or involved in such trading activities.

We are only engaging (pre-valuating) in project financing projects upon first successful pre-assessment by one of our authorized business associates and partners and submitting of the full set of application (Transaction Application File, Business Plan, Client Information Sheet, Executive Summary, POF).

We are not operating with third party agents or brokers, not linked to our code of conduct and NCNDA, as well to our General Terms.

Further, IMCI+ is never asking funds in advance, or without any service legitimation. Only directors and the Senior Management Team visible on our website are authorized to sign any legal binding documentation.

As many other companies in today’s internet jungle, we experience occasionally people using our name or fictive facts for potential harming. Please contact our legal department at legal@imci-group.com, if you are approach by suspicious individuals. Provide please names, copies of emails, bills, contracts.

Through our division of corporate finance, IMCI+ is focusing on project financing, with a private equity and venture capital approach. This combination of corporate finance and corporate consulting state of art has made of IMCI+ a very successful firm and unique in its market positioning. Since 2010 we have incorporated high level Private Equity Professionals, Investment Bankers and Asset Managers with a proven track industrial record. Together, the network team has closed more than 250 investment deals with a value of over 15 Bio. €, in all over the world. Combined with ca 600 advisory assignments (survey of 2016).

In 2016 and 2018 IMCI+ was short listed for nomination as “Best International M&A Advisory Partner – Global 2016 and 2018” by Capital Finance International www.cfi.com. We hold since 2013 two TV shows at the Swiss Financial TV – Dukascopy TV in Geneva.

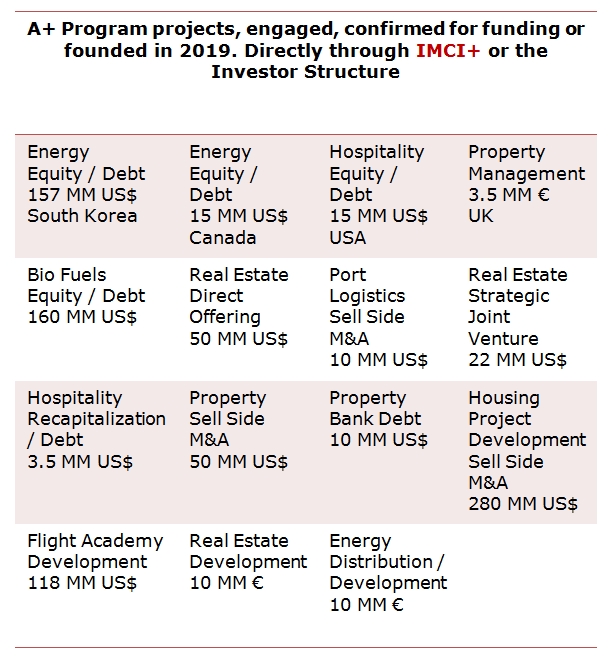

In 2019, IMCI+ has become direct fiduciary partners of Swiss-European Private Equity / VC /Investment structure, which closes yearly funding projects in the value of over 2 Billion Euros and an overall transactions volume in 2018 of over 3 Trillion US$.

A strong focus is the project financing activities with projects sizes up from 15 MM €/US$ up to 150 MM €/US$. We can also facilitate financing up to 3’000 MM €/US$.

The funding process

IMCI+CORPORATE FINANCING PROGRAM A+

This is a program of added value with fully transparency of costs. A program in which the investor and IMCI+ are at your side along the journey of your project sharing risks and benefits as partners.

The Program advances to 100% of the Net Capital for the Project, in the form of a Loan, against equity participation. IMCI+ is linked to the Swiss Structure.

The group's funds are privately held and directed based on IMCI+’s Pre-Assessment and Desk Valuation (Engagement Phase) and second in the Execution Phase (Due Diligence, Report), recommendations and decisions from key shareholders and the Investor’s Group Advisory and Credit Committee.

Through this program, IMCI+ is able to facilitate and offer debt, equity, mezzanine or a mix of funding solutions including the refinancing of existing loans, purchase of existing facilities, restructures, etc. The preferred investment sectors and industries are: Alternative & Renewable Energy - Oil and Gas - Real Estate & Construction – Infrastructure -Minerals & Mining - Hospitality, Resorts, Casinos & Marinas, etc. - Agriculture and related industries - Environment - Technical Innovations, etc.. There are no geographical restrictions, with exception of armed conflict zones and countries listed on the United Nations Security Council Sanctions List. IMCI+ is only engaging in the funding of private projects and will not consider government projects backed by government guarantees or any form of private-public participation (PPP) project. We cannot consider any financial related structure for funding.

Key Arguments for the A+ Program

1. No Interest Rates

2. Time to market (you can obtain the Funding Commitment / Terms Sheet within 2 weeks. The funds is in your account within 8-10 weeks.

3. No upfront fees, but success and value-based payment (€10k upon submitting of the Funding Commitment / Term Sheet and 5% upon first and each drawdown into your company)

4. No lost contribution of cash participation

5. No limitations of regions and industries

6. Almost applying for most size of the deals (from 2Mio – up to 3 B US$ / Euros)

7. No hidden costs

8. Entrepreneurial VC/Equity approach sharing business risk with you

9. Large maturity period of up to 10 years

10. Possibility to exit before the maturity end, without penalty

11. No particular collaterals requested, only a transfer of 35% of the Project Company and pledge of the remaining 65% shares to the SPV, for in case of non-payment of the loan

13. You keep control of your company

14. Where the Loan is advanced for land development projects, the repayment will commence after the completion of the project’s construction. Any income from off-plan sales will be paid against the Loan. Early discharge of the Loan will be possible without penalty.

Key parameters

Program A+ = Equity based loan through SPV structure based in Switzerland or the UK – Key parameters

Capital Contribution / Transaction Costs: 2.0% initial transaction costs, but in the minimum

a) Euros 412’500 for projects from Euros/US$ 2M up to 7.4999M

b) Euros 852’500 for projects from Euros/US$ 7,5M up to 14,999M

c) From Euros/US$ 15M onward it will be 2%. This is a valid fixing until June 30th, 2020 (signed Letter of Funding Commitment/Terms Sheet).

d)

From July 1st, 2020 (date of signing the term sheet) it will be 5% minimum without exception. The Capital Contribution will ensure that the SPV is adequately capitalized and able to meet any and all subsequent costs during the Project’s development phase and during the period of the repayment of the Loan. The Capital Contribution will be repaid by the SPV to the Applicant after the complete repayment of the Loan Capital by the PC to the SPV.

SPV: The Special Purpose Vehicle (SPV) is the legal entity of the Investor, who will hold 100% (one hundred percent) of the shares and through which the investor will invest the agreed Investment sum into the PC of the Applicant. The SPV will hold 35% of the shares in the PC. The initial costs of incorporating the SPV, opening the bank accounts, providing local resident directorship, providing domicile address and including all applicable government levies and other administrative charges from time to time will be paid by The Investor.

Deal Size Focus: Deal Size Targets of €/US$ 15 Mio. – 3’000 Mio –

Materialization: Upon complete application, successful Pre-Assessment and Desk Valuation, IMCI+ will submit the legal binding Funding Commitment / Terms sheet (Funding Acceptance) in ca. 2 weeks time. The first drawdown can occur within ca. 8-12 weeks, after signing of Letter of Funding Commitment/Terms Sheet, Joint Venture agreement and the Loan Agreement, depending on where the Joint Venture firm is established (UK or Switzerland)

Industries and Regions: There are no particular restrictions. IMCI+ is only engaging in the funding of private projects and will not consider government projects backed by government guarantees or any form of private-public participation (PPP) project. We cannot consider any financial related structure for funding.

Funding Type: Venture Capital / Equity Approach. The Investor holds 35% of the project company and the client pledges 65% additionally to the SPV as security

Maturity: Maturity up to 10 years

Anticipated exit: Is possible without penalty

Interest rates: No interest rates applied or additional cash contribution necessary

Grace Period: The Grace Period will be agreed between the Applicant and The Investor and such period will be the period before the commencement of the Loan Repayment.

Securities: The securities to the Investor will be as follows: There will be a first-ranking charge over the PC’s Assets through a pledge of shares of 65% (sixty five percent) of the Applicant’s shares in the PC’s in favor of the SPV. The Applicants shares in the PC will be pledged to the SPV until such time that the Loan is repaid by the PC to the SPV. The PC will pledge all of the Insurance Policies issued to the Project Company for the Project in favor of the SPV. The securities to the Applicant will be as follows: 1. Blocked Capital Contribution Funds in the SPV Escrow account until first Drawdown; 2. JV Agreement and Loan Agreement in favor of the Applicant. The PC will transfer within 5 (five) Banking Days after the notification that the first draw is available in the SPV in favor of the PC, 35% (thirty-five percent) shares of the PC to the SPV and issue a share certificate for the 35% shares in the PC in the name of the SPV. The transfer must be officially registered with the local authorities and all applicable documents must be sent to the SPV.

Exit of investor: By maturity of the loan, exit of the investor at a fair market value of the project company of the client. The market value will be arranged through an auditor. Upon disagreement, both parties will assign own auditors. The average price will be considered

Anticipated exit request: The client is allowed to exit the Lender before the maturity. There is no penalty. However, the loan payment must be fully completed. And the exit price agreed

Project Audits and Project Management: Project Audits and Project Management will be carried out by The Investor or one of the Audit and Management Firms to be appointed by The Investor. The purpose will be to ensure that the Loan funds are disbursed and directed in accordance with the pre-approved Projected Cash Flow and the Business Plan.

Project Valuation: Is applied in two phases. 1. Pre-Assessment and Desk Valuation: In order, the application is accepted for financing, IMCI+ is requested to run a Pre Assessment and Desk Valuation, with the respective report to the investor, before obtaining the pre-acceptance and Letter of Funding Commitment / Terms Sheet. 2. Due Diligence: The Investor will run a DD through a big four or specialized firm, or through IMCI+ Group Intl. Ltd. after the Letter of Funding Commitment and the execution process. The DD costs will be paid by the investor out of the Joint Venture Escrow Account.

Corporate Governance: The Investor requires an equal number of the seats on the PC’s Board of Directors plus the casting vote until its Unreturned Capital Contribution Account has been reduced to zero, and not less than 50% of the seats for the duration of The Investor’s holding of shares in the PC. IMCI+ will be assigned as an independent director in the client’s project company.

Success fees: IMCI+ is not asking any upfront fees. IMCI+ is operating on success and value base: First success payment: upon reaching a pre-acceptance and the Letter of Funding Commitment (€10’000) and Second success payment: upon materializing of the loan with 5% of the loan sum, which will be added to the loan and paid out on each drawdown payment of the investor into the joint venture escrow account. Any further or side advisory will be charged upon agreement.

TIMELINE

We guarantee you that upon receipt of the full application; you will receive a first official reply within 72 hours. And upon positive desk valuation, a positive pre-acceptance within 4 days and the legal binding Letter of Funding Commitment, inclusive Terms sheet within 15 days ca. and the first drawdown into your company ca. 8-10 weeks later (after the finalization of the Joint Venture Agreement, Due Diligence, the opening of the Escrow Account and the SPV.).

So from the time, you present the completed application, until the funds are in your account, you should calculate ca. 10-12 weeks.

More information on Financial Services and Capital Investment Services >>

More information on Corporate Finance Consulting >>

More information on International Project Financial Management >>

More information on Investment Management Firms >>

More information on Financial Strategies Business >>

More information on Working Capital Finance >>

IMCI+ Corporate Finance develops financial solutions and offers investment opportunities to investors.